P2YL | 15. Seven more secrets for living posh when feeling poor

Disclaimer: I’m not a financial professional and this doesn’t constitute financial advice. My aim is to share suggestions of what I personally found helpful. Always use your own judgement and make your own decisions about any personal money matters.

1. UK-based? Sign up to Martin Lewis’s MoneySavingExpert.com weekly emails

I must have saved hundreds of pounds during my ‘poor but posh’ years through following some of the suggestions on household bills, banking & saving, income & budgeting to be found at www.moneysavingexpert.com, hosted by on-the-side-of-the-consumer financial journalist Martin Lewis.

Through his weekly emails I found among other deals a credit card that paid me £100 simply for using it and paying it off every month for a period of time. Plus a little-known British Gas deal that was so cost-effective it earned the admiration of an energy adviser years later.

I'm guessing there must be equivalent legitimate advice sites in other countries if you do some research.

2. Have you considered having an interest-paying current account and using a credit card for transactions instead of your bank account?

Once you’ve mastered the art of keeping your bank account always in credit, you might like to sign up to a current (checking) account that pays you interest for this accomplishment.

I did this and used a credit card instead of my bank account to pay for as many things as possible, so keeping the figure in my current account as high as possible during the month.

I scheduled Direct Debits and any regular outgoings to leave my account as late in the month as possible before I got paid.

Result: my bank paid me interest every month.

By doing this, I was effectively playing the bank at their own game. I racked up free, extra money in my account to use for those important little things in life.

Now I'm married and financially in a different position, we still do something similar: we put as many costs as possible on a credit card, keeping our current, ‘off-set mortgage’ account as high as possible until the credit bill needs to be paid, which means we’ve saved thousands of pounds in mortgage interest-charges over the years.

We watch the date our credit card bill becomes due each month like a hawk, and always pay it in good time so we never get caught out with having to pay interest charges on it.

3. ‘It’s great fun finding out what you can do without’

These were words of wisdom from my mother when I was a young adult but only later on did I learn the truth of them.

See ‘Poor but posh’ for how I deliberately swapped certain things out of my life to afford some ‘necessary luxuries’.

It's mentally and spiritually freeing knowing what you can get away with not having.

4. Spare bedroom? I signed up to the local theatre ‘Digs List’

This was a very handy way of regularly injecting some extra money into my finances with minimum inconvenience. Theatre people are out doing a performance in the evenings when you are in, and are in during the day when you are out at work, so you can co-exist very happily.

A theatre run in a provincial city is usually a week or five days so you don’t have enough time to get fed up with each other. At the end of the week you've earned money for doing practically nothing except the satisfaction of knowing you're supporting the arts.

Christmas pantomimes usually run for a month or so and I personally found this a wonderful way of boosting my income at an expensive time of year.

5. Do you have your own Personal Fund?

Regularly setting money aside for myself was healthy for my own sense of morale after the misery of divorce.

Your Personal Fund is something you put aside every month that builds up and is yours to dedicate to whatever you want personally: clothes, beauty treatment, special hobbies, special treats, courses, long-term aspiration.

I once used mine for a whole day's style and colour consultation to upgrade my personal appearance. Years later I'm still benefiting from what I learnt about getting the best out of clothes and colours.

Another month I used my Personal Fund for events at the London Design Museum where I enjoyed meeting people of real quality and distinction, most of whom were men.

When spending your Personal Fund, choose carefully and consciously. And occasionally, con brio!

6. Are you prioritising paying yourself — saving?

I put money into a tax-efficient savings account every month and all these years later, my husband and I still use this account as a foundation we add to for extra holiday spending-money.

7. Have you learnt how other women did it?

We can learn from savvy women of the past who faced similar money challenges and in many ways were up against an even tougher world for women.

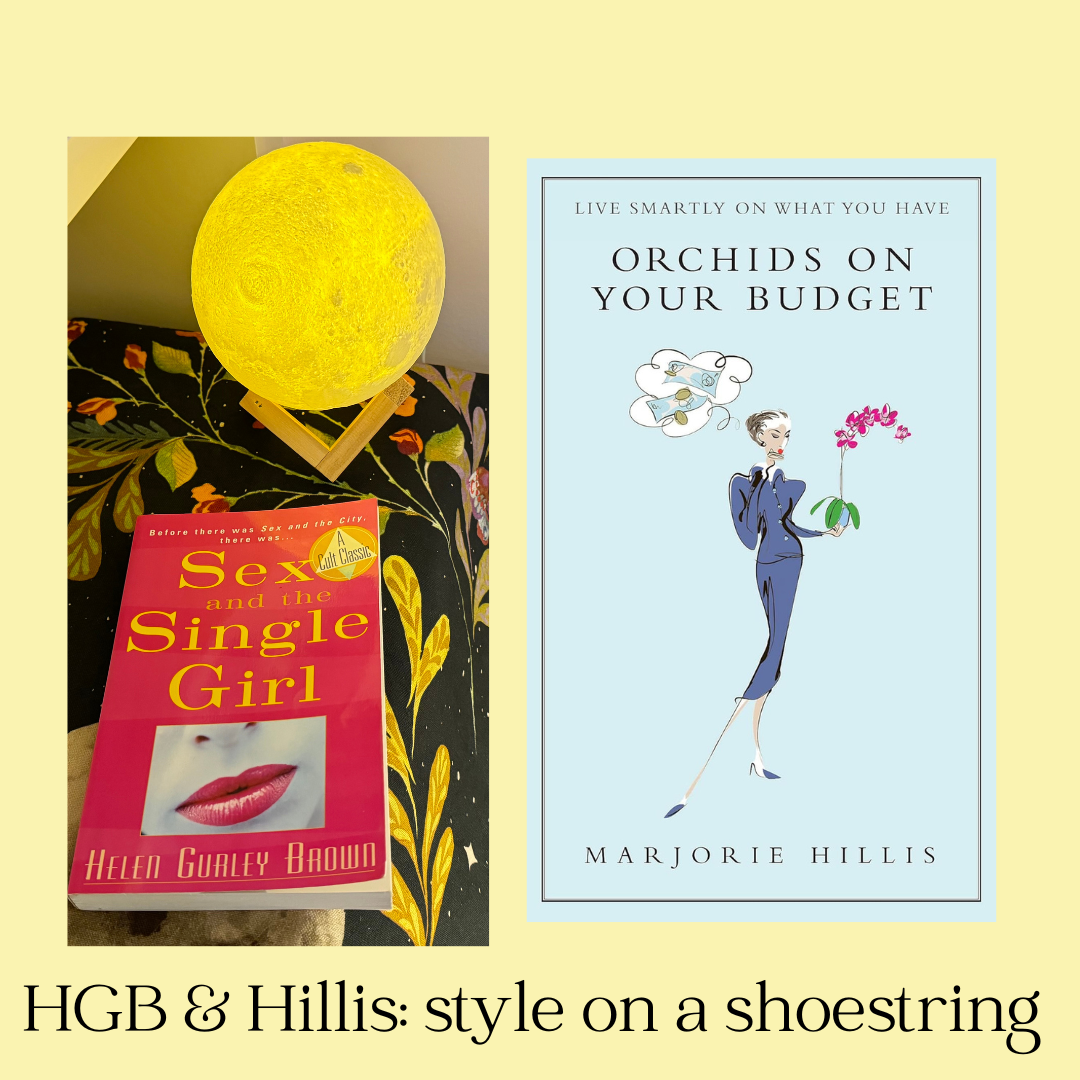

For sheer energy, enthusiasm, and many ideas which are still practical with a little 21st century fine-turning, I rate these two which can be found online or secondhand:

Sex and the Single Girl by Helen Gurley Brown, former editor of US Cosmopolitan

Don't be misled by the title; it includes a certain word simply because HGB and her husband were media professionals and knew the notoriety would be good for sales. The book is actually about many aspects of being a single, independent woman — finding enjoyable work and performing well at it for example — and it includes a useful chapter ('Money, money, money') on making your money go as far as possible while still living a stylish, fun life.

Orchids On Your Budget, Or, Live Smartly On What You Have by Marjorie Hillis

Marjorie Willis wrote the iconic Live Alone and Like It in the 1930s for the first generation of Western women who were living independently away from home and it's still an uplifting read.

Orchids On Your Budget is the sequel, packed full of infectiously fun inspiration plus case-studies of women finding clever ways to achieve a quality life on a slim income.

Got any personal finance tips that help make the money go round?

🌿🌿🌿