P2YL | 14. The £1 notebook that saved me thousands

Or, Money without tears

In P2YL | 13. ‘Poor but posh’ I told you how I swapped out some elements in my life in order to afford ‘necessary luxuries’ which are important for your morale if you find yourself dealing with divorce or heartbreak at some point in your life.

Crucial to my ability to do this was a method of money-control that I taught myself when I was broke and in my first job. I felt a nagging sense that a grownup woman should be able to handle her money capably, which I wasn’t doing at that point.

And if I wanted to attract a partner who handled money well and wisely, I felt I should aim to be that too.

So when many years later I found myself divorced and poorer, after fourteen married years of having no money worries, I deployed my money-method again.

'Meet your new daily Wordle/Sudoku'

My method means doing a tiny bit each day. Or every other day. Sounds laborious? No, because once you've learnt it, it’s as easy and addictive as doing a daily Wordle or Sudoku.

I was never overdrawn again. It helped me combine living affordably whilst enjoying my 'necessary luxuries'.

Its gift was a sense of calm control that is the essence of inner style.

Facing the financial looking-glass

In the beginning I was a 25-year-old secretary with ideas above her stationery. I looked in the financial mirror and didn’t like what I saw.

Why was I overdrawn at the end of the month when the last time I looked at my bank balance there seemed to be enough money?

Because your bank statement is always out-of-date.

What were these ‘fees’ that kept appearing on my bank statements?

Because, as the bank smoothly informed me, every time I overspent by a penny, quick as a flash they would slap charges on every single transaction I made. Not just for a day or two. For the whole of the next three months.

I was effectively giving away my money, money that could be used to create an enjoyable and productive life.

What to do? I had always been hopeless at maths and still dread the word 'spreadsheet'.

But I tried a simple experiment and it turned my life around.

Step 1. The £1 notebook that turned my life around

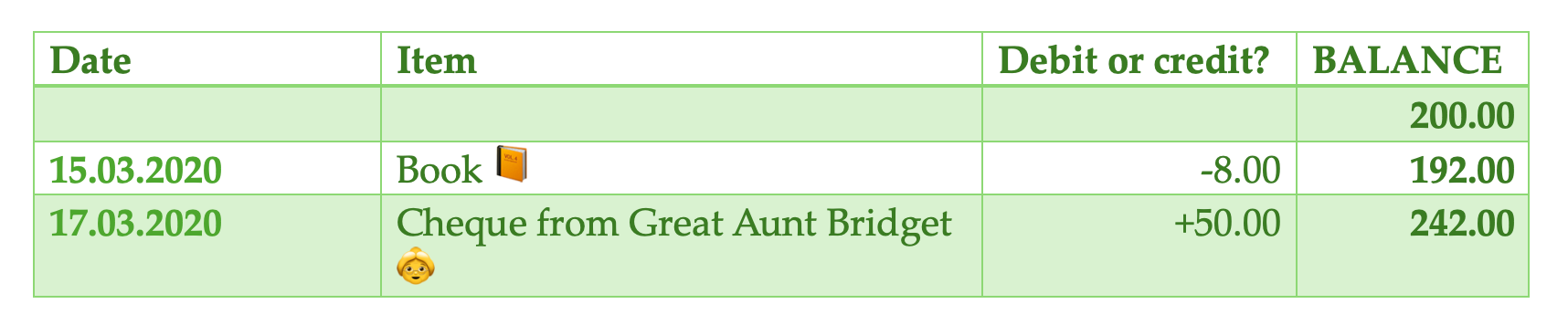

I bought a pretty notebook, opened it at the first double-page spread, and neatly ruled four columns. Taking my latest bank statement, I found the total figure at the bottom of the statement. Was this what they called my 'balance'? Otherwise known as 'the bottom-line'? I felt clueless.

Anyway, I wrote that figure in the ‘Balance’ column:

That’s it.

That was all I needed to kickstart my own version of feminine financial control.

Now each time I made a banking transaction, (ie not cash purchases, only things that were going to appear on a bank or credit card statement) I wrote it down in the notebook, took it away from or added it onto the figure in the Balance column, to give me a new End Balance:

All you need to start with is a sense of the money-pattern coming and going. No stress. Just a little each day. If I missed a day out it was a simple matter to catch up.

Step 2. Financial fortune-telling

The little notebook also gave me the power to look into the future.

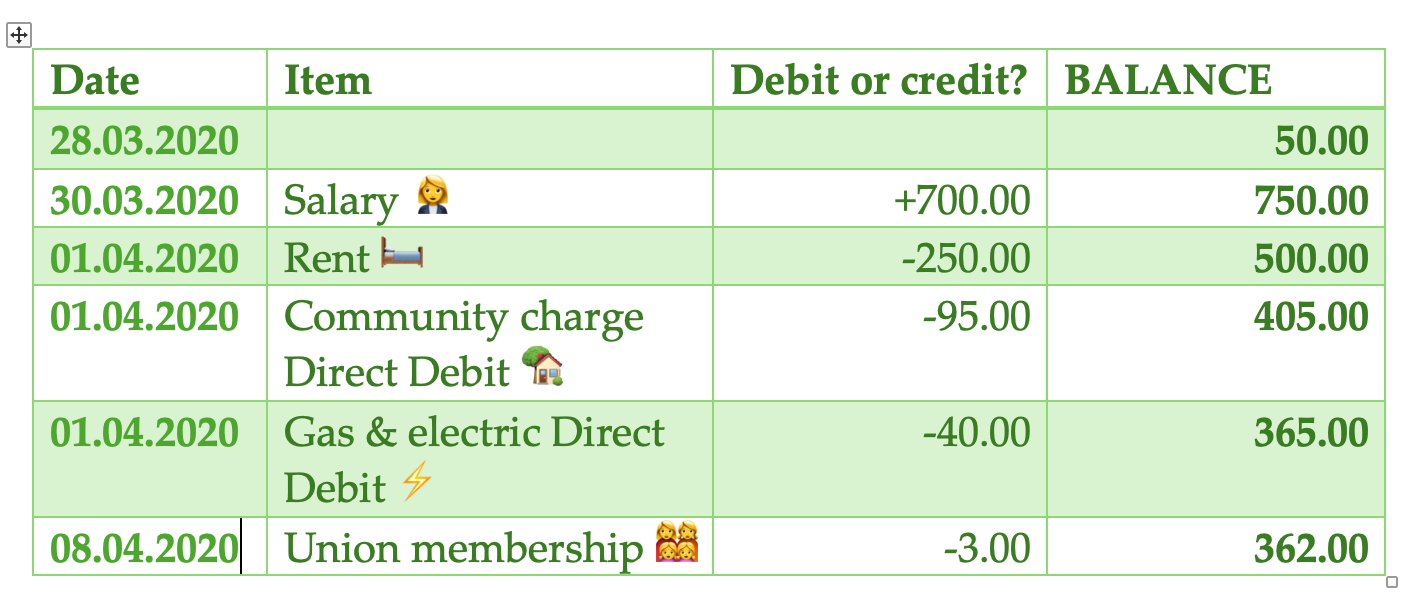

There were these annoying things called 'Direct Debits' or ‘monthly outgoings' that came up each month.

Previously I had only been aware of them after the money had gone from my account. Now I began to take control of them by listing them on the blank page I had left at the start of the notebook.

Then at the start of each new month once my salary had been paid, I would immediately write down the dates and amounts of any upcoming regular Direct Debits before they hit my account.

It looked something like this:

Step 3. Finding authentic balance

And so on with all my monthly outgoings till I reached my real balance, not the bank's version of it. I had now found an authentic figure I could rely on.

Finding real balance, authentic balance, in whatever area of life, is a step on the route to freedom, financial or otherwise.

By this method you create a protective money-buffer each month.

Never mind that the money values above are unreal. The method itself is the point: a neat and easy way of taking ownership of your money for the future.

Quite literally, ‘fortune’-telling. Then you can take that fortune-telling one step further.

Step 4. Fortune-telling +

What about the bills that weren’t handy, predictable, Direct Debits, but were going to come up as one big frightening figure at some point?

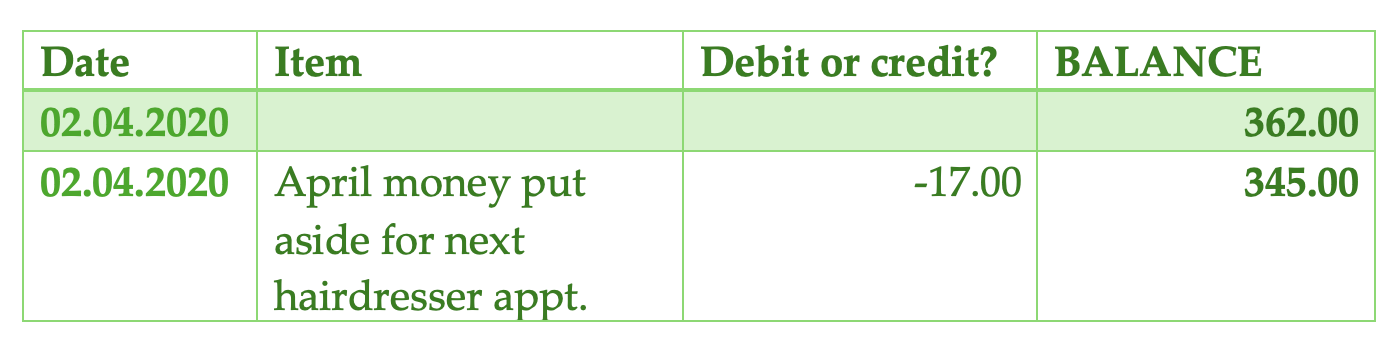

I took the fear out of them by cutting them down to bite-size pieces:

🤔 I asked myself, what bills are going to come up say every three months? To start with one less expensive but vital one: getting my hair cut and coloured regularly, which is one my 'necessary luxuries' as you'll know from 'Poor but posh'!

💇♀️ If a hair appointment costs £50 and I want my hair cut four times a year, I’d think:

£50 x 4 = £200 per year in total.

£200 ÷ 12 months = about £17 per month (actually £16.66 but I can’t be bothered being too fiddly)

So at the start of each month, down that would go without fail in the notebook:

I did this month-by-month for any important future payment.

At that point in my life I didn't have a car and couldn't drive, but to this day I handle 'car expenses' including MOT, tax, insurance, yearly service, breakdown membership, like this, putting a certain money in a 'Bills Fund' account each month.

But that's for women who've reached Elite level at my money-method — link coming soon.

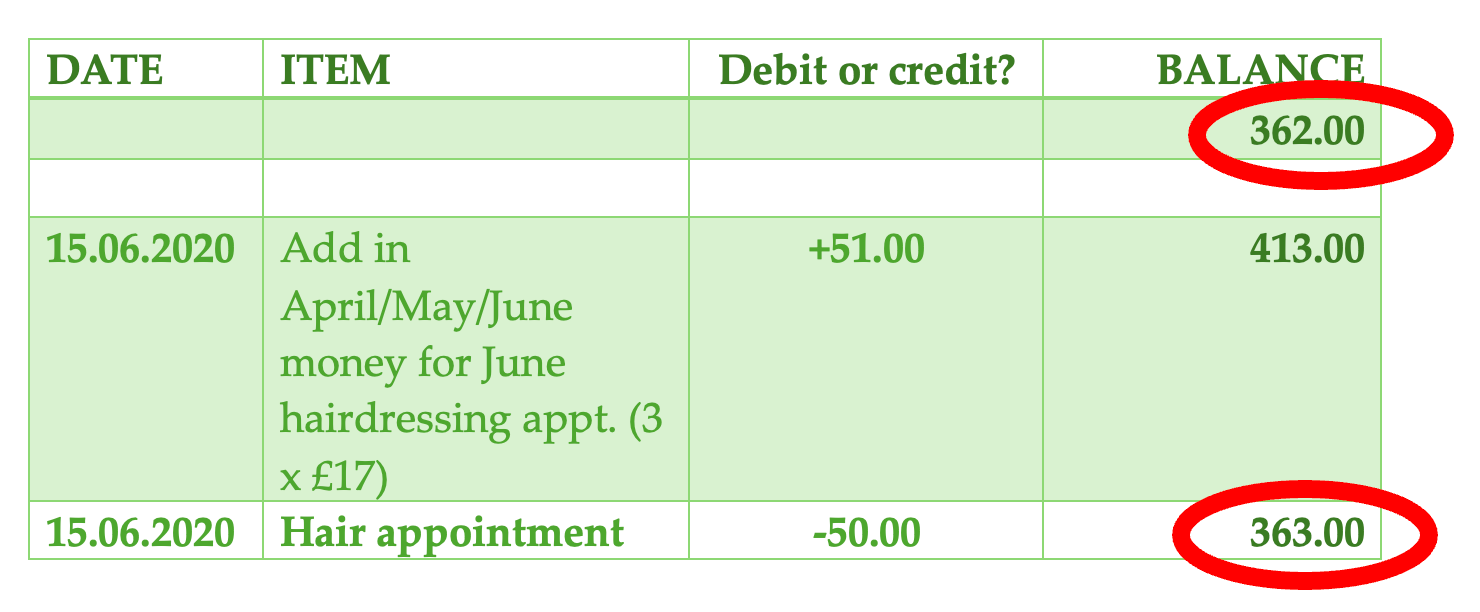

Can you spot the difference below?

There is no 'magic money-tree' but there is a sort of alchemy that happens if you use this method.

It was June. I went to the hairdresser for a haircut and highlights. And entered it in my notebook like this:

Did you see what happened there?

Not only did I have a chic new classic bob and a hairdresser I could pay without a thought, I was actually £1 better off than I was before.

OK only £1 but you see the inherent potential here?

Organic money-control

Some people do this with a spreadsheet but the pretty paper-notebook-and-pen method works for me and is an achievable method of money-control.

What I've shown here is just how I started. Over time and as I got better at it. I gradually finessed it while all the time keeping it plain and simple. It has enabled me to live surprisingly well on less money. I also noticed during my dating years that the men I got to know, including my future husband, have all been impressed by my ability to handle money, even if I'm not a financial whizkid and words like insurance, pensions, mortgages do my head in.

The important thing is knowing enough to get by and stay in control, and after that I'm happy to use my husband's superior financial skills for the more complicated stuff.

Most importantly of all I find it brings a sense of calm and wellbeing, knowing I have control of my money.

Effectively it is a form of power for women.

Feeling inspired? Try my bonus chapters:

💳 Take it to the next level: extra money tips and tricks

Coming soon: 👑 Reach Elite level: the icing on the money cake

🌿🌿🌿